Technical/scientific Challenge

In the ever-changing financial markets, adaptability and innovation are crucial for sustained success. Smart-Markets GmbH is an SME that develops and offers automated trading robots for medium to long-term stock trading and foreign exchange (forex) Day trading. Since market dynamics change over time, the performance of a trading algorithm diminishes when it is not able to adapt to market changes. Therefore, maintaining continuous effectiveness of the trading robots is one of the major challenges for Smart-Markets, currently requiring continuous back-testing and recalibration of the trading robot algorithms.

Solution

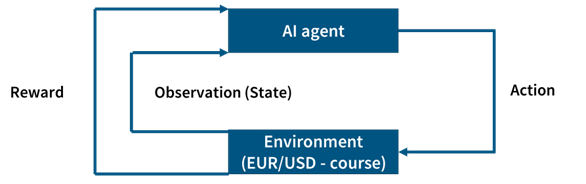

To address this challenge, Smart-Markets collaborated with SIDE in a Proof-of-Concept (PoC) study to explore using advanced Machine Learning techniques, specifically Reinforcement Learning, to improve the adaptability of their trading robots. As shown in Figure 1, the robot traded in the EUR/USD stock market. More than 10 years of high frequency tick data, which records every price change in trading, was used for the training and the subsequent test-trading of the agent.

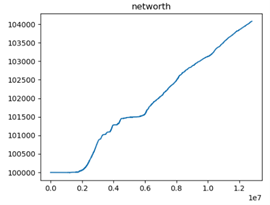

Figure 2 depicts the results for a simplified scenario, in which no trading fee was applied for the transactions. After an initial random action phase in the first years of trading, where the net worth of 100.000 USD did not significantly change, the agent started making its own trading decisions. Evidently, the predictions of the agent were sufficient to achieve a continuous profit over several years of trading, even in periods of overall negative trends.

Benefits

- SIDE helped Smart-Markets leverage HPC resources for processing and analyzing large-scale, high-frequency financial data.

- The PoC enabled the testing of AI-based trading robots, which could be adapted to changing market conditions within Smart-Markets trading strategies.

- This PoC serves as a model for exploring broader adoption of advanced computing in the financial sector and beyond.

Results

With AI expertise provided by SIDE, this PoC allowed Smart-Markets to explore a new technology without first needing to acquire AI experience. The results show that an AI-based trading robot has the potential to trade profitably over multiple years by dynamically adapting to market changes in real-time. However, within the scope of this project, it was not possible to train a robot that makes a profit in realistic scenarios where a fee is required for each action. To adapt the trading robot to realistic scenarios in the future, the scope of this PoC could be significantly expanded by e.g. incorporating data from several trading prices into the training model.